Medicare [Part A] covers some of the expenses incurred from medically necessary skilled nursing care when such services are delivered by a Medicare-certified provider. There are certain stipulations that must be met before Medicare will pay.

Medicare [Part A] covers some of the expenses incurred from medically necessary skilled nursing care when such services are delivered by a Medicare-certified provider. There are certain stipulations that must be met before Medicare will pay.

For instance, one must have already had a hospital stay of at least three days, and admittance into the facility must take place within 30 days of release from the hospital. Medicare does not cover the cost of non-medical, assisted living services if that is the only type of care needed. When these stipulations are met, Medicare will pay the full cost of care (in a semi-private room) for the first 20 days. Between 21 and 100 days Medicare will pay all expenses except for coinsurance of $164.50 per day (in 2016). After 100 days, Medicare ceases to provide coverage.

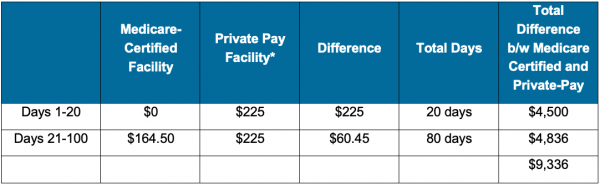

This chart compares the out-of-pocket costs in a private-pay facility versus a Medicare-certified facility:

*National average daily cost of semi-private room in a skilled nursing facility. Genworth 2016 Cost of Care Survey

As the chart illustrates, one’s maximum financial exposure in a private-pay facility compared to a Medicare-certified facility over the first 100 days is approximately $9,336. This assumes that Medicare pays the maximum amount allowable, which is not always the case. Beyond 100 days, Medicare does not pay anything so all care received at that point would be out-of-pocket, regardless of whether or not it is received in a Medicare certified facility.

Note: The 100-day period under Medicare can reset if there has been a substantial break in time between two separate stays in the health care facility. Therefore, the total difference could ultimately be more than what is shown on this chart if there are multiple qualifying stays. For more information see the CMS official government booklet titled, “Medicare Coverage of Skilled Nursing Facility Care.”

Used with permission By myLifeSite