One of the more common questions we hear from consumers about life plan communities (aka continuing care retirement communities or “CCRCs”) is how monthly CCRC fees adjust if one person is still living independently – sometimes called “residential living” – while the other requires care.

One of the more common questions we hear from consumers about life plan communities (aka continuing care retirement communities or “CCRCs”) is how monthly CCRC fees adjust if one person is still living independently – sometimes called “residential living” – while the other requires care.

The answer to this question differs depending on the residency contract type. You can learn more about the various types of residency contracts by reading A Primer on CCRC Residency Contracts. Generally speaking, this situation will work one of two ways.

CCRC Fees adjustment for fee-for-service (type C) contracts

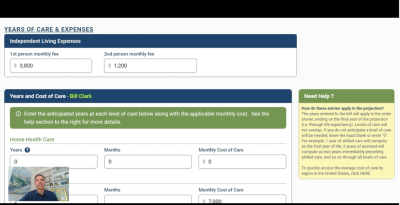

In the case of a fee-for-service contract (type C), if one resident moves to the assisted living or healthcare center, and it is deemed to be a permanent move (as opposed to a temporary rehab situation), the monthly service fee for the resident who remains in independent living will usually drop from the previous double occupancy rate to a single occupancy rate. On average this reduction will be around 20-30%. Therefore, if the double occupancy rate was previously $5,000 per month, a 25% drop would bring it down to $3,750 for the person remaining in independent living.

The person receiving care, on the other hand, will pay for those services at the prevailing market rate for the type of service(s) provided; i.e. assisted living, memory care, nursing care, etc.

Click this image to watch a short video showing how to calculate fee adjustments.

There are a couple of things to consider in this scenario. If the resident receiving care has long-term care insurance, it can help offset the cost of care services that are not covered by Medicare. Keep in mind that Medicare does not cover the cost of non-medical care, such as personal care services or assisted living. It only covers skilled nursing care, and even then just for a limited amount of time. Learn more about what Medicare covers by reading Long Term Care: What Does Medicare Actually Cover?

Another consideration is that the reduction from a double occupancy rate to a single occupancy rate for the person remaining in independent living frees up money to be used towards the other person’s care costs. Using the example above, the reduction of $1,250 could go towards the cost of care for the second person before any net new expenses are incurred by the couple.

CCRC fees adjustment for lifecare (type A) contracts

Now let’s look at the same scenario, but this time we’ll assume the couple has a lifecare (type A) contract. Unlike a fee-for-service contract, with a lifecare contract, when one person moves into assisted living or nursing care, the monthly rate for the person remaining in independent living does not drop from double occupancy to single occupancy. The potential benefit of this type of contract, however, is that the resident receiving care does not pay any additional costs for those services. With a true lifecare contract, the double occupancy rate covers both residents regardless of whether they are in independent living, assisted living, nursing care, etc.

There are a few additional things to consider about this scenario, as well. All other things being equal, the monthly cost of a lifecare contract will be higher than it would be for a fee-for-service contract. Using the same example above, instead of a double occupancy rate of $5,000 per month, it may be more like $6,000. In other words, the couple with the lifecare contract is paying more on the front end for the benefit of not having to pay more for care services if/when needed.

Another consideration regarding lifecare is that the contract typically does not cover the cost of meals in the healthcare center. Therefore, even though there would not be an additional cost paid for care services, an additional cost would be applied for the three meals a day served in the healthcare center. This could add another few hundred dollars per month to the double occupancy rate.

Lastly, even though there is no additional cost paid for care under a lifecare contract, long-term care insurance typically can still be used. Be sure to talk with your insurance agent or financial professional, as well as a knowledgeable representative of the community, to be sure you understand the details of your LTCi policy and how it may interact with a lifecare contract.

A note on hybrid contract fee adjustments

There are some contracts, including modified (type B) contracts and equalized rate lifecare contracts, that may not fall exactly into the two descriptions above. With these hybrid types of contracts, it’s important to be sure you ask and understand how pricing adjustments work should one person require care while the other is still able to remain in independent living.

Is it the right time for senior living? Take this survey and find out now!

By myLifeSite|